Calidi Biotherapeutics (CLDI)·Q4 2025 Earnings Summary

Calidi Biotherapeutics Stock Jumps 5% on IND Filing Timeline, Debt Reduction

January 29, 2026 · by Fintool AI Agent

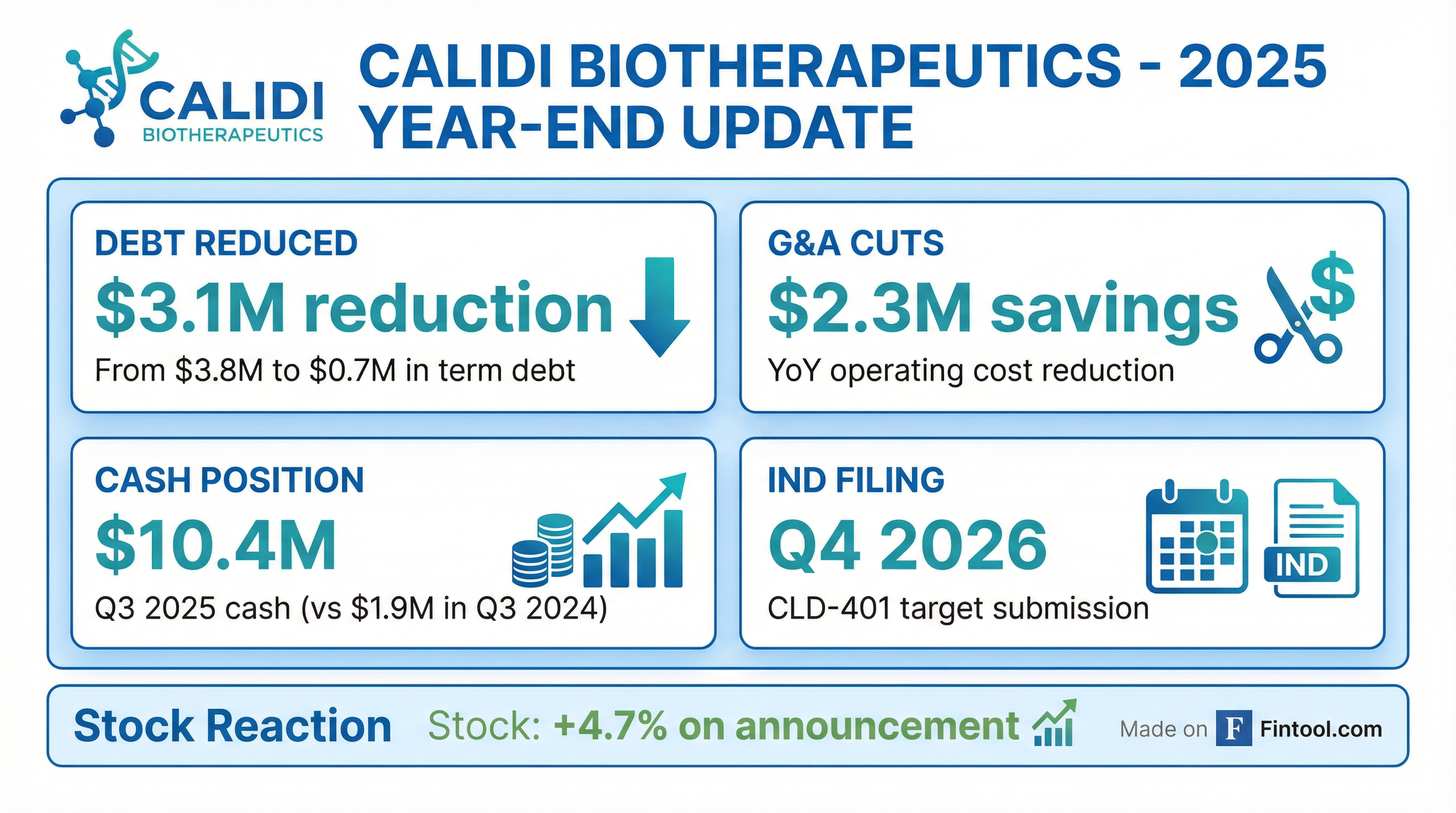

Calidi Biotherapeutics (NYSE American: CLDI) released its 2025 year-end corporate update, outlining key accomplishments and 2026 milestones. The pre-revenue biotech announced plans to file an IND for its lead RedTail candidate CLD-401 by Q4 2026, while reporting significant debt reduction and operating cost improvements. Shares rose +4.7% on the announcement.

What Did Management Announce?

The 8-K corporate update focused on four key areas:

1. IND Filing Target — Q4 2026 Calidi intends to file an Investigational New Drug (IND) application for CLD-401, a systemically delivered oncolytic virus engineered to express IL-15 superagonist in the tumor microenvironment. The Phase I study is expected to be conducted in a basket of solid tumors including non-small cell lung cancer (NSCLC), triple-negative breast cancer (TNBC), and head and neck cancer.

2. Debt Reduction — 82% Decrease Term debt and notes payable (including accrued interest) dropped from $3.8 million at December 31, 2024 to just $0.7 million at December 31, 2025 — a $3.1 million reduction.

3. G&A Cost Cuts — $2.3M Savings General and administrative expenses decreased by $2.3 million in the first nine months of 2025 compared to the same period in 2024, reflecting management's focus on capital efficiency.

4. Leadership Changes The company completed a CEO transition to Eric Poma, PhD, who brings 25+ years of biopharma experience, and appointed Guy Travis Clifton, MD as Chief Medical Officer.

How Did the Stock React?

CLDI shares rose +4.7% on January 28, 2026, closing at $1.03 on volume of 83,436 shares — above the 50-day average. The stock remains down significantly from its 52-week high of $19.20, reflecting the typical volatility of pre-revenue biotech names.

What Is Calidi's Financial Position?

Calidi is a pre-revenue biotech company. Key financial metrics (preliminary, subject to audit):

The company's cash position improved substantially in 2025, while debt was reduced by more than half. Quarterly burn rate has remained relatively stable at ~$5M.

What Are the Key 2026 Catalysts?

Management outlined three major milestones for 2026:

-

CLD-401 IND Filing (Q4 2026) — The lead RedTail candidate targeting metastatic solid tumors with IL-15 superagonist delivery

-

BiTE Proof-of-Concept Data — Demonstrating the RedTail platform's ability to deliver tumor-localized bi-specific T cell engagers (BiTEs) alongside T-cell amplifiers

-

Non-Oncology Applications — Exploring new payloads for inflammatory and immune diseases, targeting other cell types via envelope engineering

What Is the RedTail Platform?

The RedTail platform is Calidi's proprietary engineered enveloped oncolytic virus technology designed for systemic delivery. Key features:

- Immune Evasion: Engineered CD55 expression allows the virus to avoid immune clearance after systemic administration

- Tumor Targeting: Designed to home to metastatic sites and replicate only in tumor cells

- Payload Delivery: Can express high levels of genetic medicines (like IL-15 superagonist) directly in the tumor microenvironment

CLD-401, the lead candidate, showed promising preclinical data presented at ASCO (May 2025) and SITC (November 2025), demonstrating enhanced biological efficacy in immunocompetent tumor models.

What Changed From Last Quarter?

Key Risks

Cash Runway: With ~$10M in cash and quarterly burn of ~$5M, the company has limited runway. Additional financing will likely be needed before IND filing.

Clinical Risk: CLD-401 is in preclinical development. IND filing is subject to completion of IND-enabling studies and regulatory interactions.

Dilution Risk: The company has raised capital through equity offerings, and further dilution is probable given the development stage and capital requirements.

Forward Catalysts

This analysis is based on Calidi Biotherapeutics' 8-K filed January 28, 2026, containing preliminary, unaudited financial information subject to audit completion.